Fixed rates are at an all time historic low and it could be a good time to consider three to five year fixed rates.

But have you always wondered what the pros and cons are of choosing fixed rates over variable rates or vice versa? Here are some considerations for you..

Fixed rates – pros

- You know exactly how much your weekly, fortnightly, monthly repayments will be for the term of the fixed rate and hence budgeting is easier.

- When fixed interest rates are low, it makes it favourable.

Fixed rates – cons

- Break costs can be very high – if you want to pay off your loan or move banks, you may end up paying thousands of dollars.

- There is a limit on how much extra you can contribute during fixed term. Some banks allow $10,000 extra contribution per year (during the fixed term) and some may allow $30,000 during fixed term. This depends on the bank and you need to check it with your lender or your broker.

-

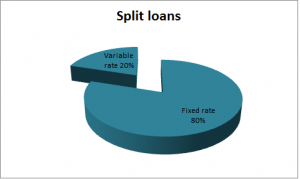

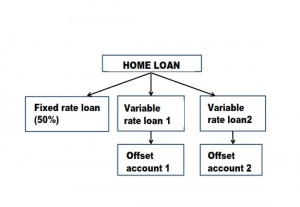

Offset account is usually not a fully offset account – some banks allow partial offset. So, if you have a lot of surplus cash, fixed rates may not be the right loan. One way to overcome this is to have a split loan with variable and fixed interest rate loans.

- Banks usually will not let you redraw the extra amount you have contributed into your fixed rate loan.

-

Fixed Interest rate without a package are generally expensive. So, even if you have an offset account and pay the annual package fee, you may not be allowed to offset too much surplus cash!

If you think you may want to redraw or contribute extra surplus cash or extract equity, but still want to enjoy the benefits of the low fixed interest rate, it is still possible! We can show you how it can be structured for your benefit.

When you consider fixed rates, you have an option to rate lock the fixed interest rate by paying fees (generally, pay 0.15% of the loan amount) to lock the rate for up to 90 days. This is possible only once you have found a property and signed a contract of sale. Banks will not let you rate lock for pre-approvals. If you decide not to pay the fee, your fixed interest rate will be as on the day of settlement.

Variable rate – pros

- As the interest rates go up or down, so will your interest rate – minus the interest rate discount you were entitled to when you originally signed up.

- You can usually make unlimited additional repayments without a penalty – either directly into your home loan or into your offset account.

- You have access to the surplus funds deposited into the home loan as redraw.

- You have an option to move banks or even discharge your loan when you choose variable rate without incurring a heavy penalty.

Variable rate – cons

- When interest rates sky rocket, you may regret not fixing your loan for a lower interest rate!

While you do have the choice to change from one to the other, before you choose an option you need to understand the pros and cons of each and also the fees involved. To switch from a variable rate to a fixed rate might only cost you a small variation fee, whereas to move from a fixed rate to a variable rate can cost you thousands depending on the balance of the loan term.