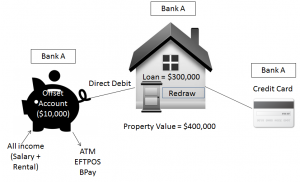

A professional package or pro pack is usually a home loan with a linked offset account and a credit card, all for the one package fee. Offset accounts are generally your everyday transaction accounts linked to your home loan. The benefit of this type of set up is that any money parked in your offset account offsets the balance of your home loan. For this to happen, your offset account needs to be a 100% offset account and not a partial offset account. (Whenever I refer to an offset account I mean a 100% offset account.)

All professional packages have different names according to different lenders, but they all use the same concept mostly.

For example, if you have a loan of $300,000 and you have a balance of around $10,000 in your 100% offset account, the interest is then calculated on a balance of $290,000 only . Since interest is calculated daily by your lender and paid weekly, fortnightly, monthly – however you choose – the balance of your offset account offsets on a daily basis.

If you have spare money, park it in your offset account. Don’t worry about the fact that you are not earning any interest. Although it is nice to see your money earning interest, if you opt for an offset account, you will enjoy the benefit of saving interest on your bigger debt, your home loan, rather than locking it away in a term deposit. If you were to be paid interest on the money in your offset account, you would eventually end up paying tax on it. Having an offset account, therefore, means that you may have considerable tax savings.

You are definitely better off reducing your non-tax deductible interest (home loan) rather than paying tax on your interest.

An example of how to save interest using an offset account:

Let’s assume you have $20,000 in your offset account. Let’s also assume you have a loan of $400,000 with an interest rate of 6%. If you were to earn interest on the $20,000 at 4.4% p.a. (in a savings account or term deposit), you would then earn $73 per month. You would be required to pay tax on this amount.

On the other hand if you were to leave the $20,000 in your offset account, you would save $100 per month off your mortgage payments and have the added benefit of not having to pay any tax on it.

This is the most preferred type of loan, especially if you think you might have some extra cash – instead of depositing it directly into the home loan, you can park it in the offset account.

You usually get a credit card as a part of the package (assuming you are eligible to receive one) and you only pay the one package fee for your home loan, offset account and credit card.

To make the best use of this loan, make sure you direct your salary (and your partner’s, too, if you are in a relationship) into the offset account, close any other bank accounts and even direct your rental income into this account.

TIP: If you are able to handle credit cards in the proper manner, use your credit card for your living expenses, leave your salary in your offset account for longer and then pay off the credit card debt before the interest-free period expires.

TIP: Most basic loans do not come with an offset account, but consult with your broker as some lenders do offer free offset accounts even with basic home loans and without any package fees!

When is an offset account not the best option for you?

- If you plan on taking up a 100% fixed rate loan. Lenders usually do not let you offset a lot of money against a fixed rate loan and in this instance you might be better off not paying the package fee. Again, different lenders have different policies and some of them might allow a partial offset, but very rarely a full offset against your home loan. If you decide to have an offset account with a fixed rate loan, be very aware of the penalties and charges that you might have to pay for having offset too much or for having gone over the accepted offset limit.

- If you want to pay off your home loan quicker and build equity. Of course, with an offset account you do save interest, but ultimately if you want to pay off your home loan you really do need to contribute extra money into the loan to bring down the debt.

- If you think you might spend the money from your offset account because of easy access. In this instance it makes sense to opt for the basic home loan and deposit all extra money into the loan itself. This restricts easy access, unlike the offset account where you can go to any ATM and use your card to withdraw money without any restrictions.

You really need to weigh up your options and your future plans before choosing one type of loan over another. For example, if you think you could have some extra dollars every month but you don’t know exactly how much, you could opt for an offset account. This could equate to saving a few years off your total term and that is fine at this point in time.