The basic home loan is the no-frills product offered by most lenders with minimal extras (no offset account or a credit card). Different banks will use different names to describe these loans but the concept remains the same. You can choose either a variable rate or a fixed rate.

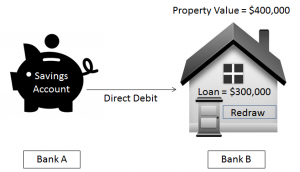

For example, you may have an everyday transaction account with Bank A and may opt Bank B for your home loan. Usually, you can set up a direct debit weekly, fortnightly or monthly to make the mortgage repayments from Bank A to Bank B.

You have an option to contribute extra money into your loan (restrictions apply if your loan is fixed). This becomes your redraw and you can withdraw the extra money contributed from your loan at any time. Some banks may have minimum withdrawal limits and may charge a fee. Internet transactions are usually free.

Basic variable loans usually have an application fee, because lenders do not charge an ongoing package fee, and you also receive a discount in the range of 0.5%-0.7% off the standard variable rate. If you are someone who doesn’t want a credit card or to pay a package fee, someone who is happy to just deposit extra money into your home loan when you want to, then this is the type of loan for you.

There could be variations of this loan with extra fees (offering offset account) or lower interest rates (honey moon period) and so on.